The Top 5 Cash Flow Mistakes Small Businesses Make (and How to Avoid Them)

Cash flow issues often sneak up on small business owners, even when sales look strong. From late invoicing to overestimating sales, these common mistakes can drain your cash and stall growth. Here are five pitfalls to avoid — and simple ways to keep your cash flow healthy.

How to Forecast Cash Flow (Even If You’re Not a Numbers Person)

Cash flow forecasting doesn’t have to be complicated. By tracking what’s coming in and going out, small business owners can spot problems early, plan for expenses, and build confidence in their financial decisions.

Why Cash Flow Matters More Than Profit for Small Businesses

Profit looks good on paper, but cash is what keeps your business alive. Learn why cash flow matters more than profit and how to keep it steady.

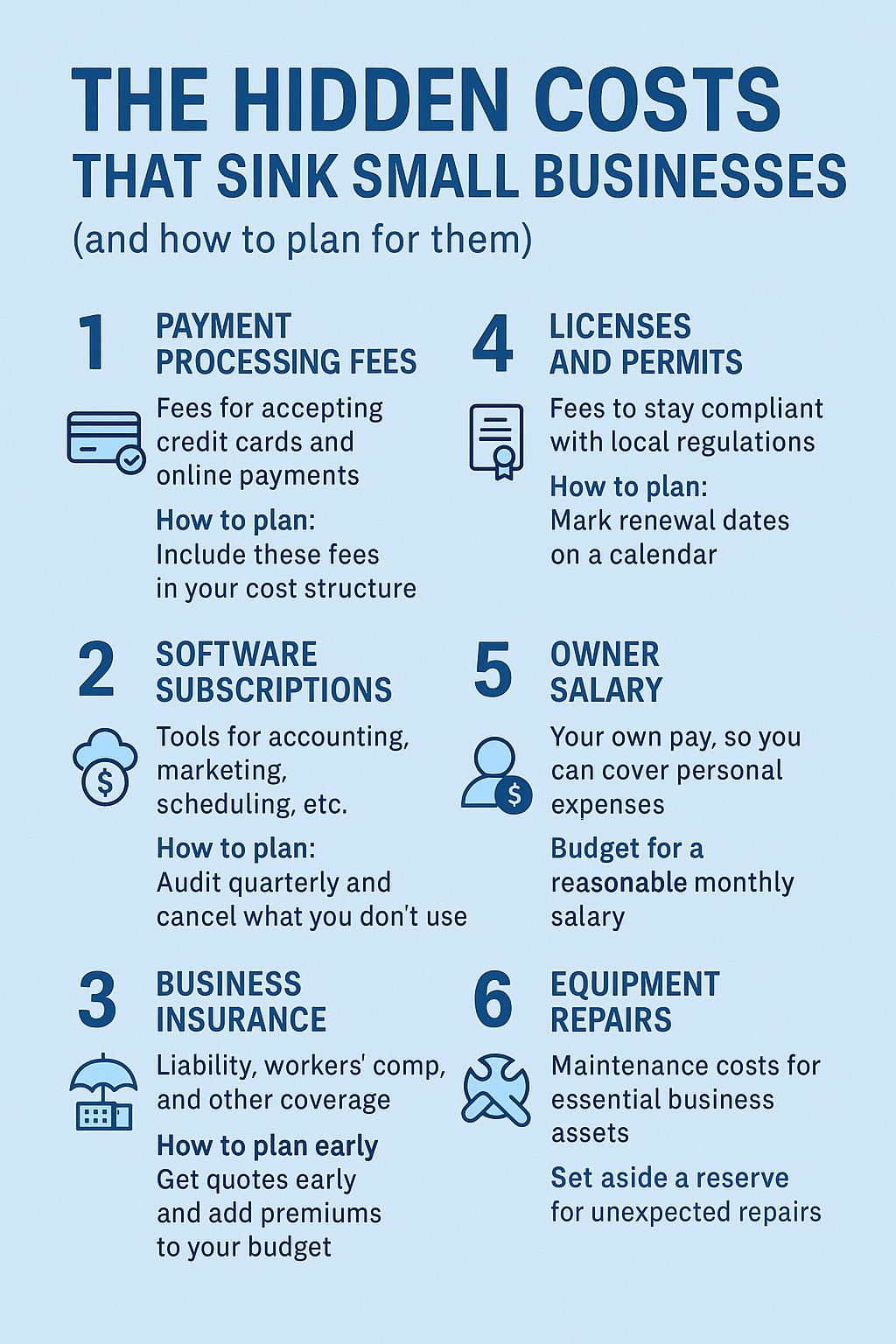

The Hidden Costs That Sink Small Businesses (and How to Plan for Them)

Even the most organized small business owners can get tripped up by hidden expenses — from software subscriptions to licensing fees. In this post, I break down six common costs that often go overlooked and share simple, practical strategies to help Modesto entrepreneurs plan for them before they impact cash flow.

3 Financial Metrics Small Business Owners Should Track (That Aren’t Revenue)

Revenue alone doesn’t tell the full story. In this post, I highlight three financial metrics — gross profit margin, operating cash flow, and net profit — that give Modesto small business owners a clearer picture of performance and sustainability.

How Small Business Owners Can Use Financial Reports to Make Smarter Decisions

Your profit and loss statement, balance sheet, and cash flow report do more than help at tax time — they guide smarter business decisions year-round. In this post, I show you how to use financial reports to improve pricing, hiring, and planning.

LLC, S Corp, or Sole Prop? A Financial Perspective on Choosing Your Entity Type

Choosing the right business structure — Sole Prop, LLC, or S Corp — impacts more than just paperwork. In this post, I explain the pros, cons, and tax implications of each entity type so you can make a smart financial decision for your new business.

The #1 Financial Move Modesto Small Business Owners Should Make in Their First Year

Many new business owners overlook the most important financial step in their first year: setting up proper bookkeeping. In this post, I explain why separating business and personal finances from day one can prevent costly mistakes — and how to do it right with simple, actionable steps